For all traders, the point at which the trend reverses marks one of the perfect trade entry points. At the peak of an uptrend, one of the popular candle patterns that signal potential reversal is the bearish engulfing pattern. It’s easy to identify and very effective when trading trend reversals.

continue to read to learn more about this pattern.

Identifying the bearish engulfing pattern on IQ Option

In order to identify this pattern, some conditions must exist.

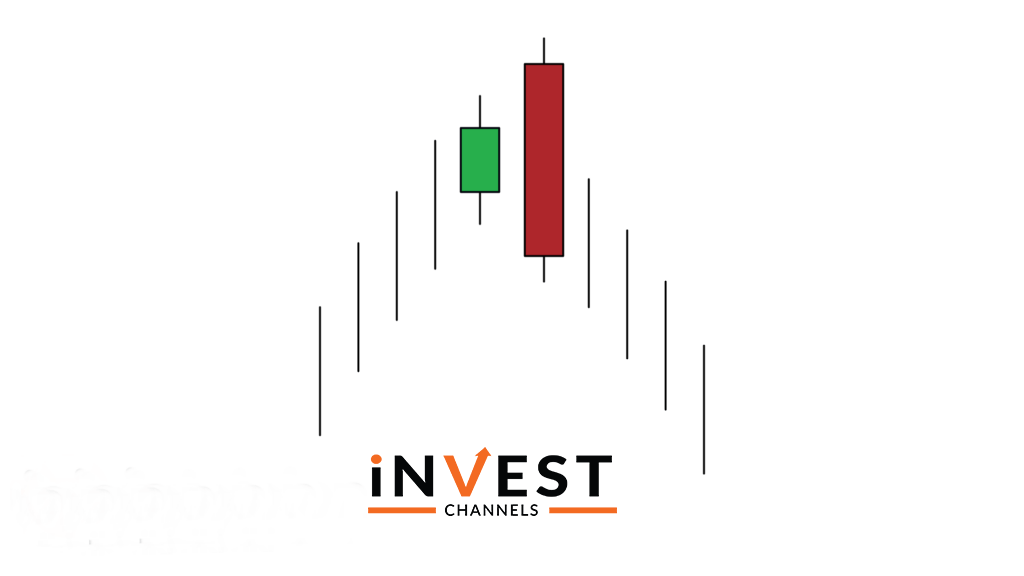

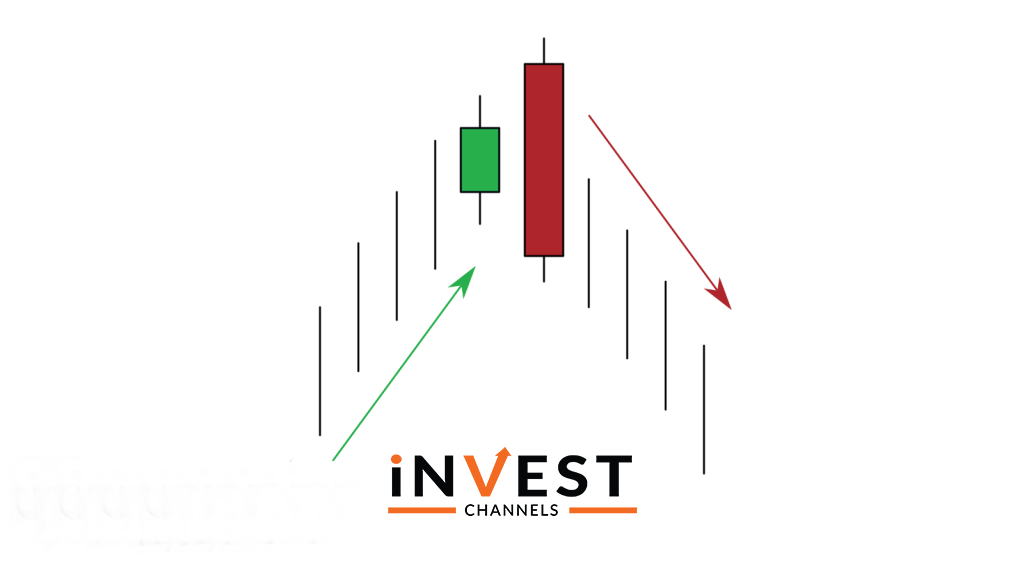

First, the trend must be an uptrend. This pattern develops when an uptrend is becoming exhausted signalling potential reversal.

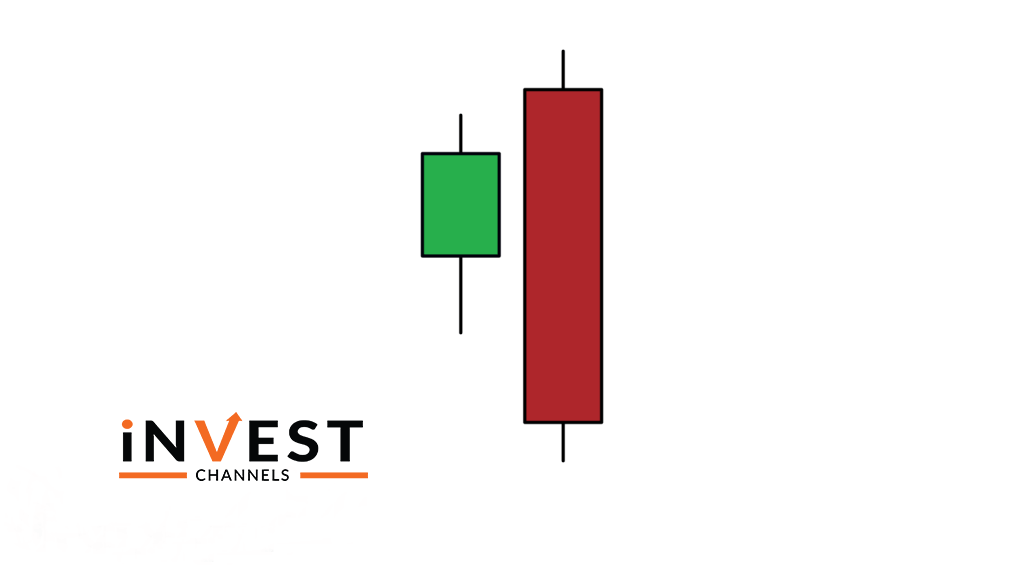

Second, the bullish candle must be smaller than the bearish candle that follows it. Note that the bullish candle must not be a doji. Dojis are easy to engulf.

Third, the bearish candle must completely engulf the bullish candle. The longer the bearish candle, the more bearish the reversal will be.

Bearish candlestick pattern

In a bearish candlestick pattern, the opening of the bearish candle is lower than the close of the previous bullish candle. Its close is also higher than that of the previous bullish candle. This pattern usually forms at the peak of an uptrend when bears finally take over the markets.

Trading using Bearish Engulfing candlestick patterns on IQ Option

As you’ve seen, the bearish engulfing pattern is quite easy to recognize. If you notice an uptrend, simply follow it until the bears step in. Remember that the final bullish candle should not be a doji for this pattern to work in your favour. Also, this is a trend reversal pattern. So whenever you encounter it, enter a long sell position.

Now head over to your IQ Options practice account and start trading using this pattern. Share your results in the comments section below.

Do you want to learn more about IQ options? check out our homepages for the latest updates.

Good luck!

Top 5 Trending

In the world of online trading — often filled with risk and uncertainty — verifying the credibility of a platform… [Read More]

Starting your trading journey can feel overwhelming — there are countless assets to choose from, and it’s hard to know… [Read More]

"Why do I keep losing money in trading?" This is a question every trader has asked at some point. Experiencing… [Read More]

Trading indices is more than just a financial pursuit; it's both an art and science, demanding attention to detail, a… [Read More]

Forget Tiffany’s—there’s a diamond that traders treasure even more. Diamond chart patterns may not sit on a ring, but they… [Read More]