Choosing an asset for a digital option

From the list of trading, instruments pick digital options and select the asset you’d like to trade.

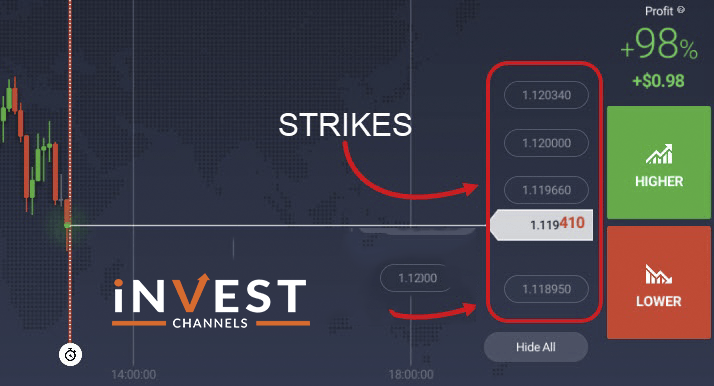

What are strikes in digital option

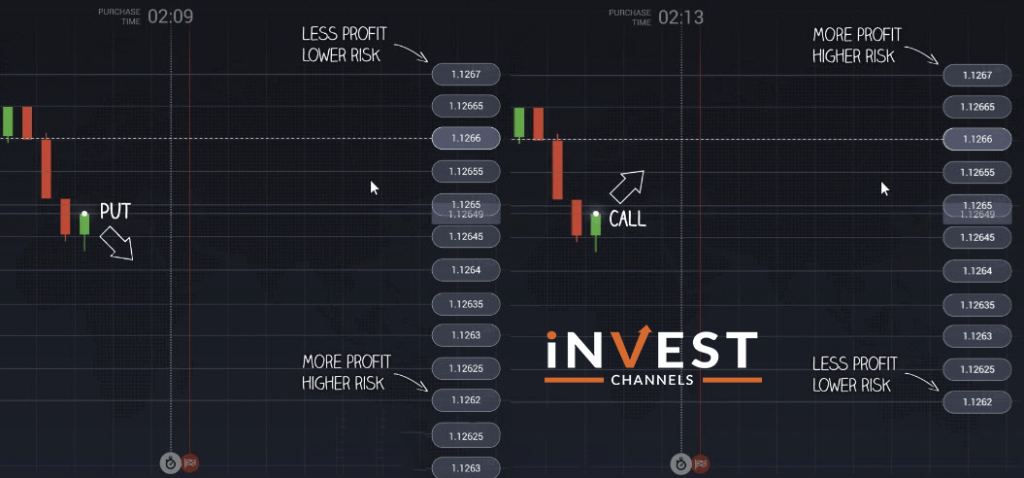

Notice how the chart is accompanied by several parallel lines. Those are known as strikes. Target price levels that the market is supposed to either surpass or stay below.

Click on the strike price that you believe to be achievable. You will see the profitability for both calls and put options change accordingly in real-time. This way you are able to evaluate your potential profit and risks at a glance.

Keep in mind the more attainable the strike price the lower the profit is going to be and vice versa.

Profit potential with digital options

A single digital option can generate up to nine hundred percent of profit if the price of the underlying asset is moving steadily in your favour.

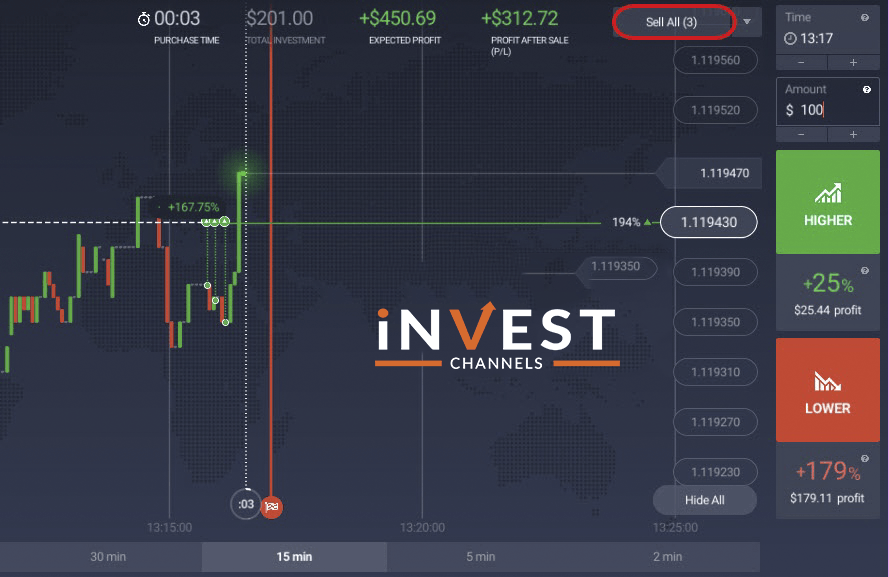

Selling digital option before expiration

You don’t have to wait for the option to expire. Just click sell the option at any point to either secure your profit or cut losses. This feature gives you more flexibility in managing the outcome.

You can purchase multiple digital options of the same asset at various strike prices. This can give you the ability to experiment with different strategies to maximize profit and lower risk.

We wish you a pleasant trading experience.

Top 5 Trending

In the world of online trading — often filled with risk and uncertainty — verifying the credibility of a platform… [Read More]

Starting your trading journey can feel overwhelming — there are countless assets to choose from, and it’s hard to know… [Read More]

"Why do I keep losing money in trading?" This is a question every trader has asked at some point. Experiencing… [Read More]

Trading indices is more than just a financial pursuit; it's both an art and science, demanding attention to detail, a… [Read More]

Forget Tiffany’s—there’s a diamond that traders treasure even more. Diamond chart patterns may not sit on a ring, but they… [Read More]