Starting your trading journey can feel overwhelming — there are countless assets to choose from, and it’s hard to know where to begin. Should you trade stocks, commodities, or currencies? Which ones are worth your attention?

If you’re confused, there’s a simpler way to participate in the markets — through an instrument that lets you trade a basket of assets instead of a single one. This instrument is called an ETF.

So, how does ETF trading on IQ Option actually work, and is it a good place for beginners to start? Let’s explore this step-by-step guide.

What Exactly Is an ETF?

ETF stands for Exchange-Traded Fund. Think of it as a shopping basket — instead of buying just one product (like a single company’s stock), you purchase a whole basket containing a variety of related assets.

In financial terms:

- An ETF groups multiple assets together — these could include stocks, bonds, commodities, or even currencies.

- You don’t trade one company or one commodity — you trade the entire basket.

- ETFs are listed and traded on stock exchanges, just like regular shares.

Examples:

- The SPDR S&P 500 ETF (SPY) mirrors the performance of the 500 largest U.S. companies.

- The SPDR Gold Shares ETF (GLD) follows the price of gold.

There are ETFs for virtually every theme — from technology and renewable energy to emerging markets and commodities.

👉 Important note: When you trade an ETF on IQ Option, you’re not buying the ETF itself. Instead, you’re trading CFDs (Contracts for Difference) based on the ETF’s price movement. This means you’re speculating whether the ETF price will go up or down, without owning any of the underlying assets.

How Are ETF Baskets Created?

New traders often wonder, “If ETFs are just baskets, how do I know what’s inside them? Why not just choose the assets myself?”

Here’s how it works:

- ETFs Follow Specific Rules

Each ETF is designed to track a particular index, sector, or commodity.

- For example, the S&P 500 ETF must hold the top 500 U.S. companies.

- A Gold ETF must reflect gold’s value — its holdings are connected to physical gold or gold futures.

So, ETFs are not random baskets — they’re carefully structured to mirror a specific market segment.

2. Managed by Leading Institutions

ETFs are managed by globally trusted financial firms like Vanguard, BlackRock, or State Street.

Their job isn’t to speculate but to accurately track the chosen benchmark.

Most ETFs are transparent — they publicly disclose their holdings, sometimes even daily, so traders can easily check what assets they represent.

3. Risk Diversification

When you buy one company’s stock, your returns depend entirely on that company’s performance. But with an ETF, if one asset performs poorly, others in the basket can offset the loss — helping you maintain stability and lower volatility.

When Stock Picking Makes Sense

If you’re confident in your own research and company analysis, hand-picking individual stocks can offer higher potential returns. But for most newcomers, ETFs provide a safer, more balanced, and less stressful entry into trading.

Why Choose IQ Option for ETF Trading?

IQ Option has become one of the most popular platforms for beginners — and for good reason. Here’s why trading ETFs on IQ Option can be a smart move:

- User-friendly platform: Simple, visual interface ideal for new traders.

- Low entry point: Start trading with as little as $10.

- Leverage available: Multiply your exposure — but remember, leverage increases both potential gains and losses.

- Wide range of ETF CFDs: From gold to tech, indices to energy sectors.

- Free $10,000 demo account: Practice ETF CFD trading safely before using real funds.

Pros and Cons of ETF Trading on IQ Option

Every trading instrument comes with advantages and potential downsides. Let’s break them down.

✅ Pros

- Diversified exposure: One trade covers multiple assets.

- No need for stock picking: Trade entire markets or sectors.

- High liquidity: ETFs are widely traded, ensuring active price movements.

- Transparency: You always know what the ETF tracks.

- Flexibility: Choose from countless themes — tech, energy, gold, and more.

❌ Cons

- Still involves risk: Diversification doesn’t eliminate market risk.

- Leverage can magnify losses: Use it carefully.

- Limited trading hours: ETFs follow stock exchange hours — not 24/7 like cryptocurrencies.

Step-by-Step: How to Trade ETF CFDs on IQ Option

Ready to give ETF trading a try? Here’s how to start:

1. Open an Account

Create an IQ Option account and explore the demo account first. It lets you practice trading without financial risk.

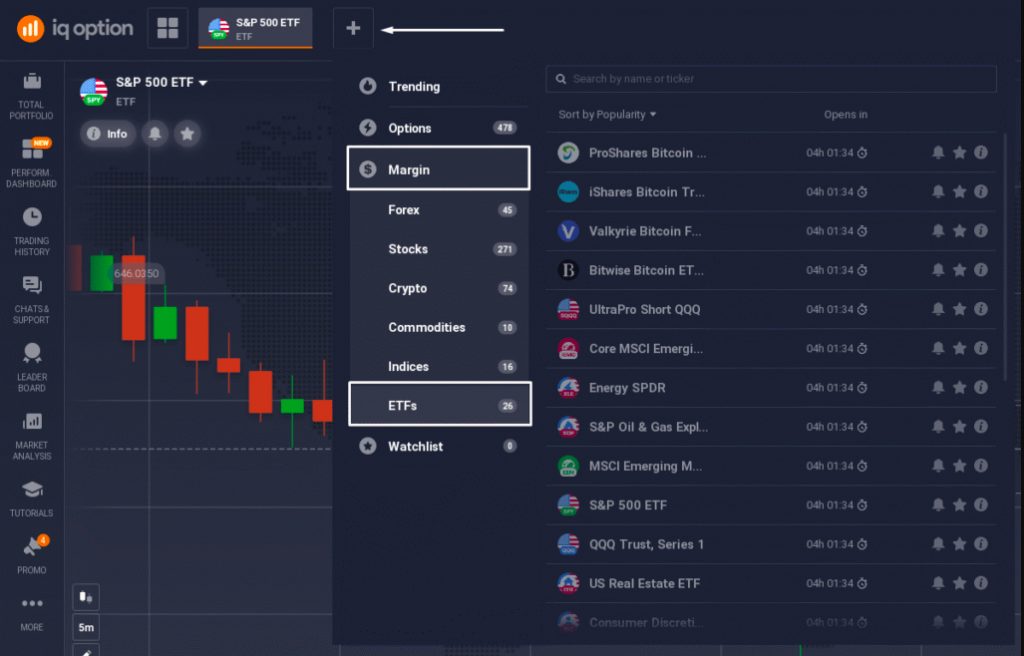

2. Choose an ETF Asset

Click the “+” button → select Margin → choose ETFs.

Pick the one that interests you — such as Gold, Technology, or S&P 500 ETFs.

3. Analyze the Chart

Use IQ Option’s charts and technical indicators to understand the market trend and key support/resistance levels.

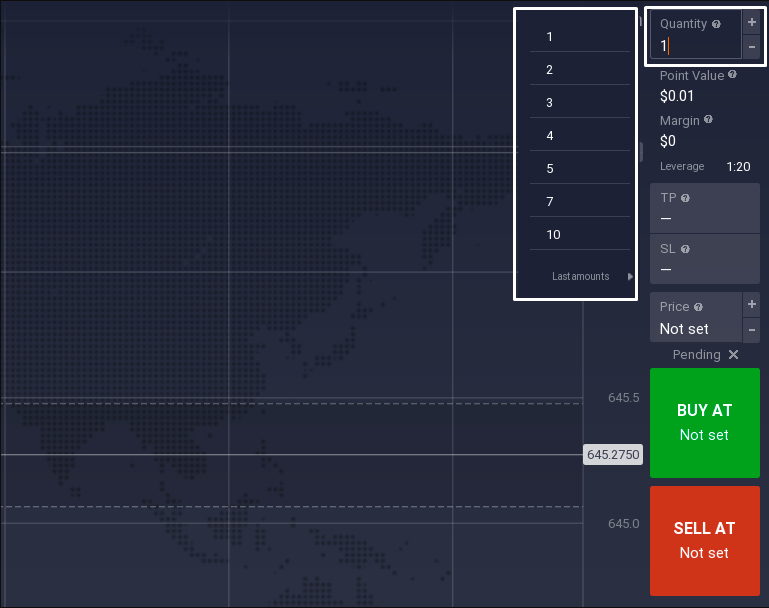

4. Set Your Trade Size

When trading ETFs on margin, your trade amount is expressed in pips — the smallest unit of price movement.

Example: If an ETF’s price moves from 100.00 to 100.01, that’s 1 pip. The number of pips determines your potential gain or loss for each movement.

👉 For detailed information, check IQ Option’s margin trading guide.

5. Understand Leverage

Before opening a trade, review the available leverage under the asset’s Trading Conditions tab.

The platform automatically calculates the required margin based on your trade size and leverage.

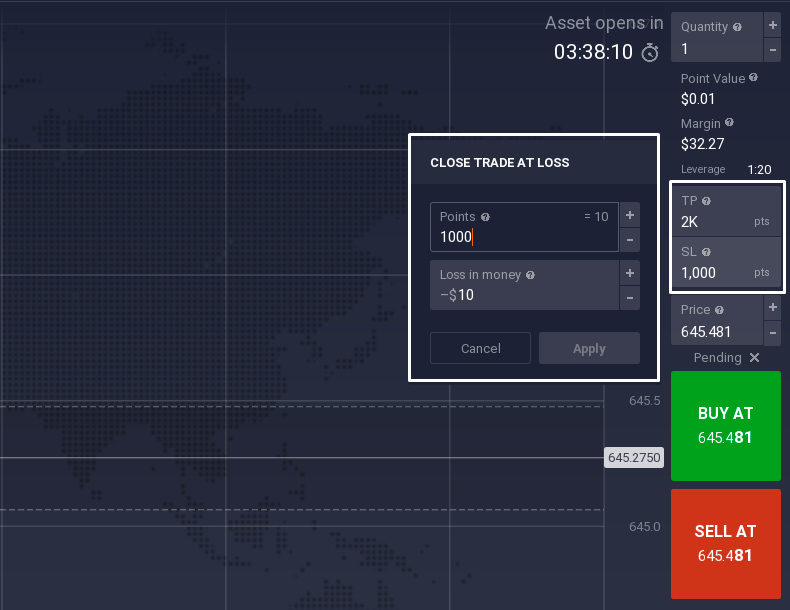

6. Manage Your Risk

- Always place a Stop-Loss to control potential losses.

- Optionally set a Take-Profit to lock in gains automatically.

- Never risk more than a small percentage of your total balance per trade.

7. Choose Trade Direction

- Expecting the ETF’s price to rise? Click Buy.

- Expecting it to fall? Click Sell.

8. Monitor and Exit

Keep an eye on your open position. You can close it manually or allow your Stop-Loss/Take-Profit to close it automatically.

Popular ETFs You Can Trade as CFDs on IQ Option

Here’s a quick look at commonly traded ETFs available as CFDs:

| ETF Type | Example | What It Tracks |

|---|---|---|

| Crypto ETFs | ProShares Bitcoin ETF, Bitwise Bitcoin ETF | Bitcoin price movement |

| Broad Market | SPDR S&P 500 ETF (SPY), QQQ Trust | Large-cap U.S. companies & Nasdaq tech index |

| Regional Markets | MSCI Japan ETF, China Large-Cap ETF | Stocks from specific countries |

| Sector ETFs | Energy SPDR, Tech SPDR, Consumer Discretionary SPDR | Industry-specific performance |

| Commodities & Gold | SPDR Gold Shares (GLD), Gold Miners ETF | Gold and mining companies |

| Bonds | 20+ Year Treasury Bond ETF | U.S. government bonds |

| Alternative/Thematic | ETFMG Alternative Harvest ETF | Cannabis or other niche sectors |

👉 Pro Tip: Start with large, well-known ETFs before experimenting with more specialized ones.

Beginner-Friendly ETF Trading Strategies

Once you’re comfortable with the basics, try these simple yet effective approaches.

1. Trend-Following Strategy

Tools: Moving Averages (MA 50 & MA 200), MACD

How It Works:

- When price stays above the MA line — it indicates an uptrend.

- When below — it signals a downtrend.

- MACD confirms trend momentum.

Trading Idea:

Buy during uptrends, sell during downtrends. Stay aligned with the broader market direction.

2. Breakout Trading

Tools: Support/Resistance, Bollinger Bands, RSI

How It Works:

- Identify strong support and resistance zones.

- When price consolidates and volatility drops (narrow Bollinger Bands), a breakout is likely.

- RSI helps avoid false entries — skip buys if RSI is overbought or sells if oversold.

Trading Idea:

Enter trades when the price breaks key levels with high volume and clear momentum.

3. News & Event-Based Trading

Tools: Economic Calendar, Newsfeed, Volume, ATR (Average True Range)

How It Works:

- Monitor financial news — earnings releases, oil prices, or interest rate decisions can move ETFs dramatically.

- On IQ Option, check the Market Analysis → Newsfeed section.

- Use Volume to gauge market participation and ATR to assess post-news volatility.

Trading Idea:

Combine fundamental and technical cues — for example, if oil prices rise sharply and Energy ETFs break resistance with strong volume, it may be a good buy signal.

Risk Management Tips for ETF Traders

Trading ETFs can be rewarding, but it’s essential to protect your capital. Here’s how:

- Risk small per trade: Never risk more than 2–3% of your total balance.

- Always use Stop-Loss: It’s your safety net against unexpected moves.

- Stay calm and disciplined: Avoid revenge trading after losses.

- Practice first: Spend time on the demo account to master strategies before going live.

ETFs vs. Stocks vs. Forex

How do ETFs compare to other popular trading markets? Here’s a quick breakdown:

| Feature | ETFs | Stocks | Forex |

|---|---|---|---|

| Diversification | Multiple assets in one basket | Single company | Currency pair |

| Risk Level | Medium | Higher | High |

| Complexity | Simple | Moderate | Complex |

| Volatility | Moderate | High | Very high |

| Best For | Beginners, medium-term traders | Stock pickers | Experienced traders |

For most beginners, ETFs provide a smoother, more balanced introduction to the markets.

Common Questions About ETF Trading on IQ Option

1. Do I actually own the ETF when trading on IQ Option?

No. You trade CFDs, which means you’re speculating on price movements rather than owning the underlying ETF or its components.

2. Is ETF CFD trading safer than stocks?

Generally yes — because ETFs are diversified. However, trading always carries risk.

3. Can I trade ETFs on weekends?

No, ETF CFDs follow stock market hours, not 24/7 like cryptocurrencies.

4. What’s the minimum to start trading?

You can begin with as little as $10, and each trade can start from just $1.

5. Which ETFs are best for beginners?

Stick to large, diversified ETFs with high liquidity, such as:

- SPDR S&P 500 ETF (SPY)

- QQQ Trust (Nasdaq-100)

- MSCI Emerging Markets ETF

- SPDR Gold Shares (GLD)

Final Thoughts

For newcomers, ETFs are one of the most beginner-friendly ways to enter financial markets. They combine diversification, simplicity, and flexibility, making them less stressful than stock picking or forex trading.

With IQ Option, you can start small, practice with a demo account, and learn how market trends work — all within an easy-to-use platform. Over time, ETF CFD trading can become your stepping stone toward mastering more advanced trading instruments.

Start learning, stay disciplined, and remember — successful trading takes time, patience, and strategy.

Top 5 Trending

In the world of online trading — often filled with risk and uncertainty — verifying the credibility of a platform… [Read More]

Starting your trading journey can feel overwhelming — there are countless assets to choose from, and it’s hard to know… [Read More]

"Why do I keep losing money in trading?" This is a question every trader has asked at some point. Experiencing… [Read More]

Trading indices is more than just a financial pursuit; it's both an art and science, demanding attention to detail, a… [Read More]

Forget Tiffany’s—there’s a diamond that traders treasure even more. Diamond chart patterns may not sit on a ring, but they… [Read More]